The copper market is facing a structural imbalance. With global demand rising steadily and production capacity constrained, price growth is increasingly likely over the remainder of the decade. Meanwhile, the race for critical minerals access is heating up, as evidenced by the U.S. President’s recent Executive Order, “Immediate measures to increase American mineral production” (March 20, 2025).

At Xenith, we’ve been monitoring these shifts through rigorous modelling and long-term scenario analysis – not just to anticipate pricing outcomes, but to help our clients make informed, ESG-aligned strategic decisions.

With our extensive global experience in both emerging and developed markets, we are ideally positioned to assist companies in crafting valuable and impactful corporate proposals for resource development.

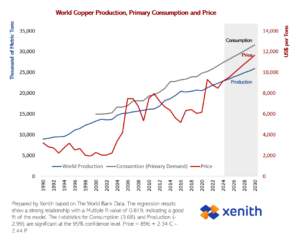

Copper prices remain closely tied to global mine production and copper consumption levels. Our conservative econometric analysis suggests price growth is inevitable over the next five years, even when recent changes in U.S. policy are considered.

Recent trends show primary copper consumption increasing by approximately 700,000 to 750,000 tonnes annually. In contrast, global production, even under optimal conditions, is only capable of expanding by around 500,000 tonnes per year, essentially incorporating no more than one-to-two large-scale projects into global production per year.

Tariffs imposed by the U.S. Administration, although their final effect is not 100% clear, could exacerbate the production-consumption gap by increasing costs for imported copper and related materials, disrupting global supply chains. Additionally, this policy might shift geopolitical dynamics as nations explore alternative trade partnerships to offset tariff impacts.

Recycling efforts, while growing in importance, have not yet reached a scale that would significantly offset these pressures.

If current trends continue, primary copper consumption could exceed 31.5 million tonnes by 2030, with global production reaching only 25.9 million tonnes. This widening gap underpins our conservative forecast of an increase in copper prices from US$9,147 per tonne in 2024 to an estimated US$11,651 per tonne by 2030.

Copper prices have not always followed demand patterns directly. In 2008, the sharp drop in prices was primarily a response to the Global Financial Crisis, which slowed industrial output and saw some investors move away from copper, which they perceived as risky at the time.

Between 2011 and 2020, prices remained subdued despite relatively stable consumption and production. This was due to a complex combination of global economic pressures, including the European debt crisis, slowing growth in China, and technological efficiencies that reduced copper intensity in some sectors.

These historical examples reflect the influence of global, macroeconomic forces. In contrast, governments around the world are now placing critical minerals, including copper, at the centre of their industrial and climate policy agendas.

Strategic implications: ESG, policy and social licence

While the price scenario outlined above may support producers and stimulate investment decisions, it could also lead to aggressive purchasing strategies, increased government tax revenues, and legislative changes designed to expedite project approval processes (such as the recent Executive Order issued by the U.S. President). In turn, this may create higher expectations and more challenging negotiations with local communities directly impacted by projects.

Given the ongoing political instability in emerging economies, this situation presents significant opportunities for new mining regions and clusters of critical minerals. Junior mining companies, often more attuned to local socioeconomic contexts, may be particularly well-positioned to capitalise on these opportunities, but success will depend on their ability to deliver beyond production targets.

To maintain momentum and secure social licence, companies must strengthen their alliances and development strategies, rooted in a deeper understanding of the broader socioeconomic benefits their projects can bring to local communities and national prosperity.

The long-term outlook for copper points to continued price growth, not as a speculative spike, but as a rational outcome of constrained supply and accelerating demand. At Xenith, we support clients in understanding these dynamics and positioning themselves strategically through a lens that integrates economic insight, ESG performance, and community value.

This is a moment of opportunity, but one that demands clarity, discipline, and long-term thinking. Fortunately, we are here to help you Know the Way. Get in touch with Xenith today.

The Latest

Explores our latest news and articles